AGRO Business Debit Card-i. The card that balances your business and lifestyle needs both domestic and internationally. It helps business thrive with a card that makes purchasing convenient and simplifies your accounting.

Features

AGRO Business Debit Card-i (ADC-i) Features

- Accepted at all 30 million Visa merchants including ATMs worldwide and MyDebit merchants nationwide

- Accepted at more than 256 automated teller machine (ATM) in Malaysia and all bank members MEPS ATM nationwide

- Cash withdrawal up to RM1,500 per transaction subject to a daily maximum limit of RM6,000 per day with the frequency of transactions is unlimited

- Daily limit for retail purchase through Visa/MyDebit is up to RM6,000

- Cardholder can make request to increase the daily limit up to RM30,000

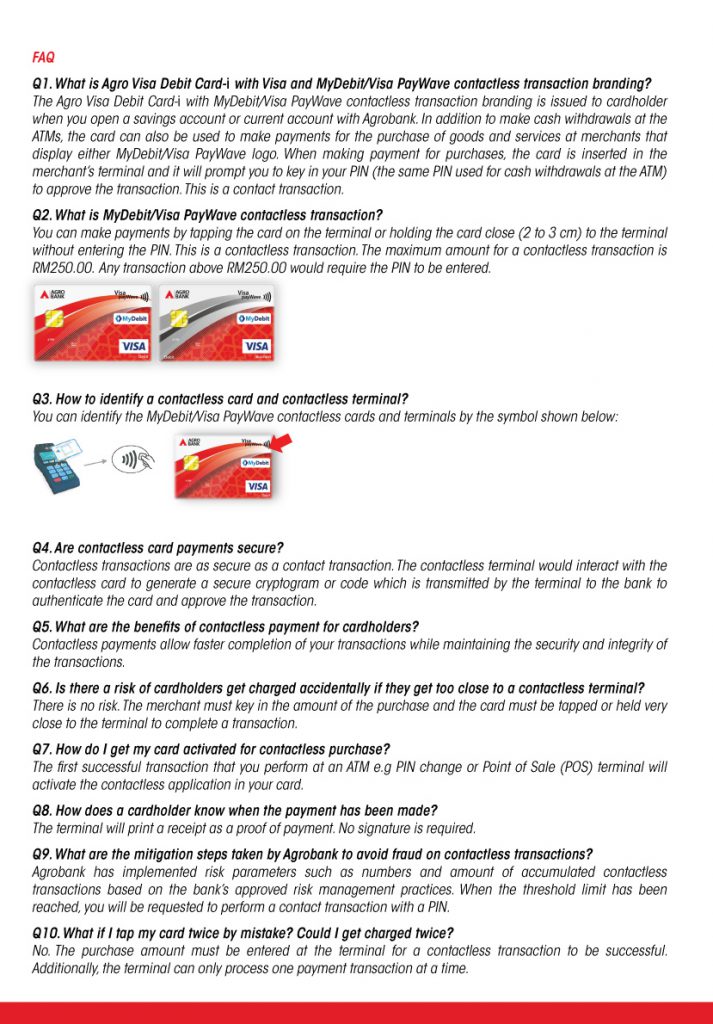

- Able to stop contactless transaction and change limit Contactless payment thru Visa and MyDebit

- Can be used to pay bills and money transfer

Benefits

- Easy and effective management

- Replaced petty cash for easier expense tracking through statements

- Its a convenient way to pay bills and manage your day-to-day business expenses

- Make payments or purchases over the phone or online to manage expenditure at your convenience

- Assured payment avoids delays with the suppliers

- Instant access to cash up through MEPS and/or VisaPlus ATMs worldwide

- Contactless technology allows you to quickly and easily make low-value payments wherever you see the contactless symbol

- Increased security with tamper-resistant smart chip and data stored difficult to be taken and copied

- Accepted at all dealers or stores that participates with Visa worldwide and MyDebit nationwide

- No income requirement for card application

- Able to check the account and transactions through AGRONet

- No government service tax.

Shariah Concept

Shariah Concept

The Shariah concept used is ujrah which paid by one party for service rendered to others. Ujrah will apply when payment imposed by Agrobank for the issuance of ADC-i to the cardholder and facilities offered from time to time to facilitate payment for the purchase of goods, services and/or cash withdrawal by the cardholder.

Eligibility

Who can apply?

- Registered sole-proprietorship company

- Account holder for Savings/GIRO account with Agrobank.

How to apply?

- Please visit Agrobank branch nearby.

- Fill in the Agrobank debit card application form when you open a Savings/GIRO account.

- AGRO Business Debit Card-i will be issued

Documents Required

- Debit Card Application Form

- MyKad (IC); or

- Kad ID Police atau Army;

- Passport (for non-resident)

Fees & Charges

Useful Information

Cardholders Responsibilities

- Once the cardholder has signing the application form, cardholder must abide by the terms and conditions for the use of ADC-i

- Cardholder must safeguard the ADC-i and PIN number. Cardholder shall not to disclose the card details or PIN to any third party

- Cardholder are not recommended to select the guessable PIN such as the cardholders date of birth, identity card number or mobile number in order to mitigate the unauthorised card usage in the event of the card is lost and stolen

- Cardholder who intent to use the card for internet and/or overseas transaction, they are required to made the request by call Banks Contact Centre or visit any nearest Agrobank branches.

- Cardholder is required to report on lost or stolen of ADC-i as soon as reasonably practicable

- Cardholder is not allowed or give authorized to any third party to use the ADC-i and may not transfer and release control and ownership of ADC-i or use it for the purpose which are not permitted by the Bank.

- Cardholder is required to check the account statement or passbook from time to time to ensure the transactions performed is properly executed

- ADC-i is prohibited to be used for any unlawful activities. Bank has the right to immediately terminate the ADC-i facility if the cardholders are found to have used the ADC-i for an unlawful activity

- Cardholder shall inform Bank if there is any change in contact details by visit to nearest branch or call Banks Contact Centre at any time.

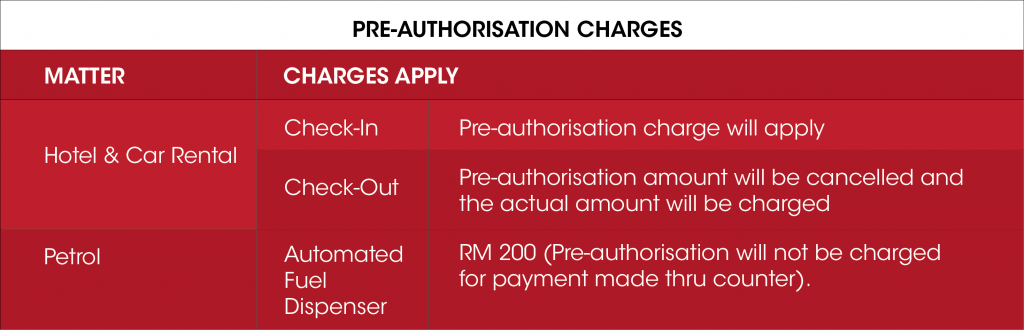

Pre-Authorization Charges

- Pre-authorisation amount will be charged to cardholders account when payment is made at Automated Fuel Dispenser (AFD) using the ADC-i. Agrobank will post the exact amount of transaction and release any extra hold amount from cardholder account within three (3) working days after the transaction date.

- If cardholder want to avoid the pre-authorisation transaction at AFDs, cardholder is advisable to go to the payment counter where the exact purchase amount would be deducted from the cardholders account or, where applicable, by selecting the exact purchase amount at the AFDs which provide such function

Contactless Transaction Info

- ADC-i details will not be intercepted and read by fraudster through a contactless reader in close proximity to cardholder wallet. The card only can read if it closes about 4cm to the terminal which accepted the ADC-i.

- Cardholder will be informed via SMS to registered mobile phone if there any transactions performed thru contactless reader.

- Cardholder only can perform transaction for (3) times per day only with amount below RM250 at a single receipt thru contactless reader.

- Payment can be taken twice from the account if cardholders accidentally tap the ADC-i twice at the contactless reader. Two (2) receipts will be printed in the contactless reader if the transaction has taken twice. Cardholder shall get advice from the merchant to reverse back the transaction.

Card Care Tips

- Some things that you should avoid:

- Striking the chip with a sharp or metal object.

- Bending card excessively or for a long time.

- Bring cards to place that have a strong magnetic force.

- Keep the card in a hot place for a long time.

Contact Centre assistance

Please call Agrobank Contact Centre at number 1300-88-2476 for any queries or to report on lost or stolen card.